Review of Canadian high-interest savings accounts: online banking with Citizens Bank of Canada, ING Direct, and PC Financial

First published on November 6, 2006

July 10th, 2007 note: I have spun off a separate site to deal specifically with high interest savings accounts: highinterestsavings.ca. Therefore, the three reviews below will be maintained and updated there.

If you have access to a computer and you’re not yet doing online banking, get with the program! Save time and money by conducting day-to-day transactions such as bill payments online; while you’re at it, stop giving the big banks funds to re-distribute to their shareholders. Consider a high-savings account at one of the “online” banks for rates that are comparable to GICs! When I first heard of ING Direct (when I was first considered online banks) a few years ago, I was wondering, “is it for real?” The answer is a resounding yes — these are all real banks, their web interfaces are secure, and you are covered under the CDIC.

Once I went the online banking route, I have never looked back. Most of them suggest that you still keep at least one account at a bricks and mortar (b&m) bank, which is a good idea. Whenever you open an account with an online bank, simply mail in a void cheque (they will give you detailed instructions on how to do this) and you will be able to electronically transfer between your b&m and online accounts. Electronic transfers usually take 5 business days.

Here is a review of the three banks that I have accounts with:

A caveat: I’ve tried to cover all of the main points as accurately as possible. Feel free to leave a comment to this post asking me any questions about banking with these three banks, as I have accounts with all three of them and do not work for any of them! However, please visit the banks’ respective websites to get the most updated information!

————————————-

ING Direct

Website: http://www.ingdirect.ca

Account of note: Investment Savings Account, 3.5% as of April 11th, 2007

Catchy ads and fun newsletters call attention to what is actually a rather limited account. You must rely on linking this account to another bank (once you do this, you can transfer money between banks for free), as there are only 7 ATMs in Canada where you won’t be charged fees to withdraw money directly from ING Direct. This might actually encourage you to save your money…

What ING Direct has going for it is the simplest online interface I have ever seen. Online banking beginners will enjoy the flat learning curve:

Key Details

-no minimum balance required

-no cheques available, no online bill payment system

-very accessible customer service by phone

Interesting Facts:

-Get a $13 sign-up bonus by registering at http://www.ingdirect.ca/en/ISAfriends/ before the end of the 2007 (that page says until the end of 2006, but it’s still valid). If you don’t know anybody who has an existing ING Direct account and you need a referral code, ask me for mine. I’d post mine publicly, but that might defeat the unbiased approach I’m going for…

————————————-

Citizens Bank of Canada

Website: http://www.citizensbank.ca

Accounts of note: Ultimate Savings Account, 3.55%; Investment Savings Account, 2.4% as of April 11th, 2007

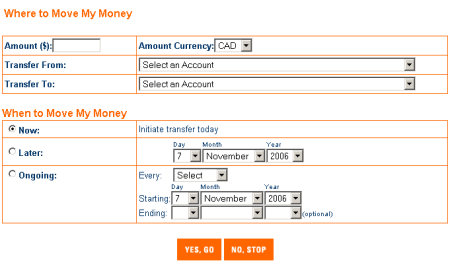

Citizens Bank is actually a Vancity company, and is my favourite bank. You get free cheques on the Investment Savings Account, and can transfer funds between that account and the Ultimate Savings Account instantly (instantly as in… as soon as you click the button!).

Therefore, keep as much money as you can in the Ultimate Savings Account and transfer it to the Investment Savings Account whenever you need it (this transfer happens instantly).

Regarding ATMs, Citizens Bank is on the Exchange network, which HSBC and all of the BC credit unions are a part of. Did somebody say coverage?

Key Details

-no minimum balance required

-pair the Ultimate Savings Account and Investment Savings account for a powerful combo

-free cheques, free bill payments

-four free debits from ATMs on the Exchange network, which should be plenty if you use your credit card as much as possible…

Interesting Facts:

-Ultimate Savings Account’s interest rate is unofficially pegged at 0.05% higher than that of ING Direct’s

-If you’re familiar with credit union online interfaces such as Vancity’s and Envision’s, you’ll feel right at home

-Call their customer service line (available 24/7) and get some of the same representatives that handle Vancity’s customer service. They’re not supposed to reveal this fact, but some of them will admit it…

————————————-

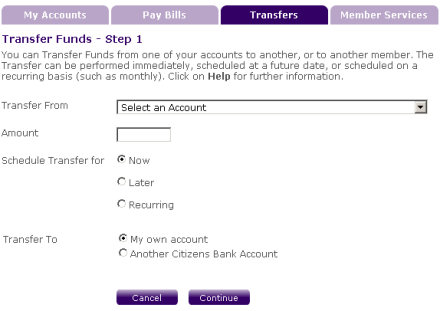

PC Financial

Website: http://www.banking.pcfinancial.ca/a/products/savingsPlusAccount.page

Account of note: Interest Plus Savings Account, 4.0% for balances over $1,000; No-Fee Bank Account, 0.10 to 0.50% as of April 11th, 2007

If you have over $1,000 to save, use PC Financial. Otherwise, consider ING Direct or Citizens Bank.

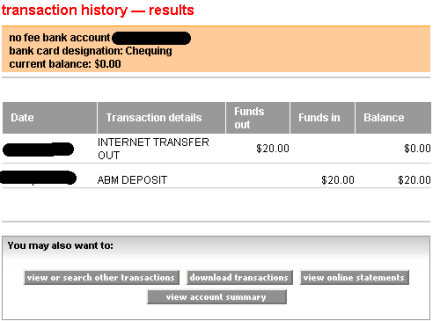

If you have a Superstore near you, head into their financial pavilion and set the account up in person. Then pair the Interest Plus account with the No-Fee account to enjoy free everything (cheques, bill payments, withdrawals from PC Financial and CIBC machines). Just be sure to only transfer as much as you need, when you need it to the No-Fee account. Currently I have $0 in my No-Fee account.

I find the interface a bit clunky, but it just takes some getting used to.

Key Details

-no minimum balance required in the No-Fee chequing account

-free everything (practically): just transfer money (allow yourself 24 hours, unlike with transferring between Citizens Bank accounts) from the Interest Plus account to the No-Fee account

Interesting Facts:

-PC Financial is now a divison of CIBC. This hasn’t seemed to negatively affect account features or service.

————————————-

The bottom line:

Use ING Direct for the easy-to-use interface.

Use Citizens Bank for the most powerful, flexible account with the best feature-to-rate ratio.

Use PC Financial for the highest rate if you have more than $1,000.

Extra reviews:

Here’s a guy who was looking at some less mainstream high-interest accounts, such as Achieva, Cataract, and Dundee: High Interest Savings Account Search. He ended up going with Achieva.

Facebook

Facebook Twitter

Twitter Email this

Email this keung.biz. Hire my web consulting services at

keung.biz. Hire my web consulting services at  Follow us on Twitter

Follow us on Twitter

November 6th, 2006 at 2:42 pm

sac says:

I think you really captured the essence of poo in your header image. My excretions always come out smiling.

GREAT post! Really makes me think about how little money I have for saving up.

For PC — is there any intrest accumulated in the no-fee account? And hey, where are these 7 ATMs that won’t charge you fees for ING??

November 7th, 2006 at 8:29 am

Brian Crozier says:

Hi Peter,

I found your blog from a google news alert, very interesting.

Another reason to get online banking.

www.usemybank.com, we leveraged online banking to make instant online debit payments to Sellers with UseMyBank. Cash online.

I would like a referal code for ING.

Thanks,

Brian

November 10th, 2006 at 8:44 am

Leah says:

I also use all three accounts (thanks to Peter). One thing I find very valuable with ING Direct is that they tell you how much you’ve earned in interest for the year. This is helpful if you’re trying to limit your earnings to $50 (so you won’t be taxed on them).

Also, ING Direct has short-term GICs so if you’re doing some short-term planning (or you expect interest rates to go up) they have 3 different terms that are less than one year in which you can earn a higher interest rate than the regular savings account!

I actually don’t like Citizen’s as much as Peter. I find that it is not as user friendly. If you want to transfer money back into a regular account (not a Vancity one) you have to enter the account information in every time. Well it seems quite petty, it actually deters me from doing transfers with them (maybe that’s their goal).

As for PC Financial, I actually only have their interest savings-plus account and not their no-fee account. I have linked it to my “brick and wall” bank account and can transfer funds easily. I agree, if you have the $1000, definitely use this one.

Lastly, from an accountant/tax planning perspective – I would open all three accounts (like myself and Peter). Do some money management and ensure that you only make $50 in 2 of your accounts (the ING direct & Citizen’s) and dump the rest into your PC Financial account (so that you’re over the $1000 balance). This way you’ll earn $100 tax-free. While it doesn’t sound the greatest…it works and can save you a bit of money. Interest income is fully taxed so you are at a disadvantage (compared to capital gains), so this is just a way to benefit.

November 16th, 2006 at 9:32 am

christophe says:

Interesting post, Peter. Don’t forget http://www.icicibank.ca/ – I think they currently have the highest interest rate out there.

Also of interest: Coast Capital is still the only bricks & mortar bank in Canada to offer free checking (Available only in BC!)… and it’s of part the exchange network, so there are no-fee ATMs everywhere. I closed my Scotiabank checking account (for which I was being charged something like $7 a month) in favour of Coast Capital one.

December 11th, 2006 at 5:19 am

Rudy says:

Interesting posts, thanks.

One more addition is www.monequity.com, an online credit uinion in Manitoba, they currently pay 4.1%. Their ACCOUNT ATTRIBUTES are

No maintenance fee

No minimum balance

Free package of starter cheques

$500 max ATM withdrawal per day

Electronic bill payment available (phone or internet)

Daily Interest Payable on each day’s minimum balance, credited to account on last day of each month.

$1.00 per debit

$2.00 per transfers completed through Monequity Financial Service Centre

Debit card and associated privileges

Deposits via mailed in cheque, direct deposit/transfer, internet transfer

Statement viewing available online; no mailed statements or cancelled cheques returned.

By the way, your entire deposit is ensured, even if it’s above the CDIC limit!

Now, of course, there is also Candian Tire Financial… https://www.myctfs.com currently at 3.8%.

Keep it up!

Rudy

January 23rd, 2007 at 10:46 pm

Jake says:

One or two posters have stated that your interest is not taxable if it is below $50 in the year from a single bank. That is incorrect; all interest received or credited to your account during the year is taxable and should be reported on your income tax return, regardless of whether it is above or below the $50 figure. The fact is simply that the financial institution does not have to issue you a tax slip when your interest income is below $50 for the year; however, they do report to the Canada Revenue Agency all interest paid to each account holder (and your S.I.N.) regardless of its size. Therefore, contrary to the suggestion by the posters, this is not a proper (legal) tax avoidance method.

February 5th, 2007 at 1:20 am

spurl signwith says:

Thanks for taking the time on writing an article about this information…excellent.

March 6th, 2007 at 10:49 am

stewert chenow says:

it would be nice if one of the institution would create a better diagram for interest rates.such as created by the writer.

Institution”A” Gic’s 30 day=4%

Institution “B” gic”s =30 days= 3 and 3/4%

institution “C” gic’s rates 30 days= 3 and 1/2%

Institition d Gic rates for 30 days.= 3 and 1/4%…

Naturally leave the telephone number of the instituion..

this way all who come to this site would appreciate it very much..

This is only my sample.not to hurt any instituion..

March 6th, 2007 at 10:53 am

hillary kompster says:

If any individual expects the u.s. or canada to raise interest rates for the next two year, I garantee you all,that both bank heads will

not move it up…100% garantee.Mark my words..Naturally if the bank heads read my comments.they will not like it..

March 6th, 2007 at 11:04 am

mary kister says:

I always report my interest on my income tax,even if I do not get a slip. Yes a t-4 slip..Since I am an honest individual,I report it and mark on my sheet to the income tax.slip not received..This way I pay what I owe and the income tax department.will check out ,if I repoort other income too..You See ,,the income tax department does not have to much work to do..so they lookj for individual like me who report income without slip..But in all fairness ,I report every cent I earned,,,After all,I am honest…

But it would be nice If the prime minister Stephen harper,would

allow the first $5,000.00 of interest..as an exemption each year…

That would be a very nice birthday present for me and 100% sure,it would be a nice birthday present for him to…I personally think that prime minister Stephen Harper is doing a great job….DO YOU AGREE WITH ME???

March 12th, 2007 at 7:26 am

Spencer says:

Hi Peter:

Excellent article. I’m a university student looking to maximize interest on cash between tuition etc. so this was very helpful.

I’d be interested in your referral code for ING Direct.

Thanks,

Spencer

March 16th, 2007 at 9:42 pm

mike says:

thanks for this.

i also have a PCF account … Interest First and NoFeeChequing .. one drawback is that transfer OUT of the Interest First account are NOT instantaneous … next calendar day at the earliest is when you can get your paws on your own money that is in your Interest First Account. Otherwise, I like the fact that I can use CIBC bank machines and the PCF bank machines inside Loblaws .. there are Lots of CIBC’s in Toronto. Cheers!

April 2nd, 2007 at 7:07 am

Jamie says:

Thanks for the information. I’d read similar posts on US accounts but this is the only place I’d found a good side-by-side comparison of Canadian accounts. I signed up with ING and it’s fantastic!

April 9th, 2007 at 9:34 am

Ivan says:

Thank you Piter for this blog. I found it very useful. Mary Kister and Jake thank you also for helpful tips about CRA taxation.

I have PCF acc. and it is very conveniant for everyday banking. I have TD infinity acc. and all the time $3,000.00 is required to avoid $12.95/month fee (for my 200+ transactions per month).

Everything is free. Only one objection; transaction between Interest Plus Savings acc. and No Fee Chequing acc. is not a real time operation – give yourself at least 24hrs in advance to complete this.

April 11th, 2007 at 11:08 am

Thomas says:

I use Achieva Financial as an online high-interest savings account which is currently earning me 4.1 %. Details can be viewed on my similar post: High Interest Savings Account Search

April 12th, 2007 at 3:33 am

Shobana says:

Peter…a very interesting insight…Guess you should do a review on ICICI Bank…i must say that they are good…would love to read your views..

April 13th, 2007 at 2:41 pm

Roc says:

Before opening up a high interest savings account, you must consider how the interest is calculated and when its paid.

Achieva Financial offers 4.10% compounded interest and paid monthly. Steinbach Credit Union offers 4.20% interest paid annually. Which savings account is the better deal?

Answer: Achieva Financial is the better deal….Here’s how it works. Every month Acheiva pays interest to your account at 4.10%. That interest carries forward to the next month in your account. Basically your earning interest on your interest. Steinbach Credit Union pays you once a year interest paid to your account calculated annually. It does not take into account the interest you earned each month.

My situation: I currently earn $1,200/month interest with Achieva on a $365,000.00 balance. But the following month, that $1,200 increases by $80 to $1280. Steinbach would pay $15,330/yr or $1,277/month. Now you can see that interest paid monthly is much better than interest paid once annually!!!

April 15th, 2007 at 1:10 pm

greyowl says:

HSBC Direct has just started a new savings account –no fees and 3.5% interest and all free features except cheques–free bill payment, free ATM access at Exchange and BMO, and free debt card transactions.

April 26th, 2007 at 5:58 pm

Kit says:

What is the TAX RATE % on interest earned? Or does it just merge into your annual income and get taxed as a whole? Great site and comments!

April 27th, 2007 at 8:07 am

Leah says:

Interest earned is lumped together with all your income; therefore, it really depends on what tax bracket you are in. Also note, the full amount of interest earned is taxed while capital gains are only taxed at 50%. Hope that helps!

May 7th, 2007 at 12:45 pm

beau says:

Thanks for the post! I’ve been with ING for a while but I think I will open a PCF acct. One thing I like about ING is they always have contests – right now they pick a person each month and they will match your monthly savings contribution for the month. I think these little contests are pretty cool – you have nothing to lose by saving and you have a chance to win their contests. Also another one I heard of is Outlook Financial (4.1% savings account) – does anybody no anything about how they are to deal with?

May 19th, 2007 at 4:22 pm

Darkman says:

Outlook financial 4.1% is basically the same product as Achieva financial 4.1%

Both are virtual accounts .. with no branches ( I have both of them by the way )

Outlook is a division of Assinaboine Credit Union, where Achieva is a division of Cambrian Credit Union..

With both you are allowed one Free withdraw / check / debit per month…

Each additional withdrawal is $1

with Achieva – bill payments (regardless of amount) – .50 cents a bill payment

With achieva .. – 1 Free debit a month is in a form of a Check.. (you write check to yourself say in any amount .. or write a check to anyone else)

With Outlook – 1 Free debit is more flexible i think – either a check, or atm withdrawal, or maybe even a bill payment – qualifies as a 1 Free debit transaction..

With Achieva – i am pretty sure – you get more initial checks which are FREE.. .. with Outlook you get way less initial Free checks (but enough to get you started – like 25 i think)

With Achieva – if need more checks in the future – pretty sure you can order additional checks for FREE

Where with Outlook – if will need more checks in the future – will need to pay for them when ordering them..

Other than that.. they are the same product.. and Savings account rate is ALWAYS basically identical..

The GIC rates might vary a bit.. but more or less are the same…

Here are links to both:

http://www.achieva.mb.ca/

http://www.outlookfinancial.com/

May 19th, 2007 at 4:35 pm

Darkman says:

When i signed up to ING .. (long time ago .. i hardly use it though, currently) – they gave 13 dollars to all new customers automatically .. as a sign up bonus..

That HSBC Direct bank’s current promotion (mentioned above .. 3.5% .. with no fees banking, bill payments, unlimited withdrawals, etc .. all but check writing) – they give you 25 bucks bonus..if you signup and by a certain date have a balance of 100 dollars..

But just NOW .. they doubled it!!

As of today – their web site shows now 50 dollars bonus .. on the same conditions.. – double basically…

If you go there and it still shows 25 for you – refresh your screen then, or clean the cookies maybe, etc..

In any case.. i can use this account .. – and just signed up to it..

All HSBC ATMs and all Bank of Montreal ATMs.. – are your “home” machines .. so no interac charges if using them to take money out (same concept as PCF .. – where all PCF machines and all CIBC machines are your “home” machines)

Also all ATM machines belonging to THE EXCHANGE thingy are “your home” ones as well with HSBC Direct..

There are some.. but they vary.. – like for example in Winnipeg here, – National Bank ATMs would be part of that THE EXCHANGE as well.. – so it’s your “home” one also.. and free to use…

In other provinces there are way more different ATMs belonging to this THE EXCHANGE …

In any case here is HSBC Direct’s link:

http://www.hsbcdirect.ca/1/2/hsbcdirect

And to qualify for this 50 dollars sign-up bonus you must open account between “May 2nd and July something” (forgot exact date) .. and then folow the rules.. by which date you have to have a 100 dol balance in there..

This offer was to expire on April 30th originally.. and was only 25 not 50.. but then they extended it till July.. (still 25 though) .. but just now doubled it to 50

Keep in mind couple of things though:

– New HSBC Direct customers ONLY qualify for this bonus

– One bonus offer per address (so i guess 2 people in the same household would not open 2 separate accounts)

Have fun…

June 14th, 2007 at 11:38 am

Carolynne says:

What about http://www.hsbcdirect.ca, the Canadian Direct savings Account from HSBC offering their best rate? I have been using them and find their online service and rates very comparable to ING Direct, who I switched from earlier this year.

July 7th, 2007 at 9:27 am

Brandy says:

Peter I so appreciate all your info. Would love to have your opinion on http://www.hsbcdirect.ca.

Also could use your referral code for ING DIRECT. I just opened a PCFinancial account. Next is ING and third one I am not sure. Help with the third account would be appreciated too.

Also GIC’S short term. Now I think they only pay at the end of the term so probably be better off with a monthly compounded interest account. Your opinion is very valuable to me.

Thanks

Brandy

July 8th, 2007 at 9:21 pm

Al says:

Thanks for excellent review, Peter.

Besides PC Financial, Citizens Bank and ING Direct, several credit unions offer no-fees personal accounts (with internet and telephone banking, Exchange ATMs, etc).

While there is quite a big choice of excellent personal accounts (high interest savings and no-fees chequing accounts), I am unable to find anything comparable for business accounts.

Unfortunately PC Financial and Citizens Bank do NOT open business accounts. ING Direct only allows business savings accounts, but not regular operating/chequing accounts.

I’ve spoken to multiple credit unions (Greater Toronto Area). Most have monthly and/or pay-as-you go fees. I found two that have minimal fees, but they are not on Exchange network and you have to travel to the Credit Union to make deposits. (one cannot make inter-bank deposits through Interac network, only Exchange network allows that).

The best deal I found so far is BMO Value package ($15 monthly fees waived if there is $5000.00 minimum monthly balance in the account). Other big banks like CIBC or RBC will charge monthly and possibly additional per transactions fees regardless of balance kept in the account.

I’ve searched high and low, and cannot find anything that I like. I wonder if you have any suggestions for business accounts.

July 8th, 2007 at 10:20 pm

Peter says:

Unfortunately, I have no experience with business accounts. However, I’m working on a site at highinterestsavings.ca where others could participate and share information about the various options… just trying to decide how best to get the word out about it…

July 9th, 2007 at 8:48 pm

Al says:

Thanks Peter

I will continue my search.

For those looking for good business accounts in GTA:

Buduchnist Credit Union

http://www.buduchnist.com/business/accounts.html

seems pretty good.

The only problem is one needs to travel to the Credit Union location to make deposits. Or use exclusively direct deposit. If only it was on Exchange network, it would be perfect…

July 15th, 2007 at 2:35 pm

Denis says:

I did a pretty extensive review of savings accounts that I’ve been updating periodically, check it out:

http://www.redflagdeals.com/deals/main.php/articles/savings2/

July 17th, 2007 at 10:15 am

DMG says:

ICICI Bank Canada is offering 4.5% on CAD Savings account and 5.0% on USD Savings Account. No fees, all transactions done through online. Also you can link your chequing account from any other canadian banks to do easy transferes.

July 18th, 2007 at 12:03 pm

Steven says:

Your blog rocks! Your info is concise and easy to understand. Much better then most of the finacial websites out there.

I think I will be going with ING (the do have a cool logo after all) Any way I can get a referal code?

July 23rd, 2007 at 7:35 am

Simi says:

Hi Peter – thanks for your work – I’m a novice at internet banking but being fed up with Desjardins I’m ready to give it a try…

I would love to use your referral code for opening an ING account

Thanks again and keep up the good work,

S

July 25th, 2007 at 11:49 am

ed says:

BE VERY CAREFULL WITH ICICI. BIG ACCOUNT ACCESS PROBLEMS AND CUST SERVICE IS BASED IN INDIA> not woth it

August 1st, 2007 at 10:06 am

elia says:

I have accounts with ING and PC financial.

PC financial lets you do more things (transfer/bill payment, etc). And their savings account give you 4% if you have more than $1000.

ING is really great too for saving (only 3.5%, but they usually have a lot of promos going on like the 4.25% for this summer07). Customer service is great!

August 9th, 2007 at 11:07 pm

bsk says:

Canadian Tire Financial Group offers 4.5% high interest saving account too. But 2 conditions: 1. only apply for the money deposit more than 90 days. 2. only apply up to maximum $50,000. If doesn’t meet these 2 conditions, the interest rate 3.8% will be apply.

August 13th, 2007 at 10:20 pm

Bill says:

I have had nothing but problems with ICICI Bank. If you deal with ICICI directly, get used to hearing the phrase “Thank you for your patience.†an awful lot. That is the first phrase they learn to speak in India where their support is located. If you bank with them, just remember the 3 I’s stand for It Is India.

http://www.mouthshut.com/product-reviews/ICICI_Bank-925004492.html

September 7th, 2007 at 10:49 am

Money must work 4 ME says:

I have $1000 with its’ work gloves on. PCF or ING direct?

September 7th, 2007 at 11:00 am

Peter says:

I don’t really recommend ING much anymore. If you just want a high rate, use PCF.

Also, check out www.highinterestsavings.ca!

September 10th, 2007 at 4:09 pm

wade says:

Why ^ ?

Please share with us your opinion why you cannot recommend ING?

September 10th, 2007 at 4:18 pm

Peter says:

There’s just nothing distinguishing about ING. Sometimes they run contests. It’s a trusted brand. But that’s it.

September 24th, 2007 at 7:06 pm

rsm says:

Could you send me a referral code for the $13 bonus at ingdirect? Thank you.

October 5th, 2007 at 4:45 pm

Tynker Belle says:

Anybody have any information on how I can open a savings account in Canada? I live in Michigan (Port Huron Area) and am very close to Sarnia (can see it out my apartment window). If i do begin to invest in a foreign country the only foreign country I can get to easily is Canada, so it would make the most sense to me to open an account there. Any information would be greatly appreciated.

October 9th, 2007 at 4:26 pm

Kerwin says:

I believe the best way to go with Banking these days is to use PC Financial’s No Fees Checking account along with HSBC’s Online Direct Savings account.

HSBC (as stated above) provides everything you will need in a chequing/savings account in an all-in-one account (except for No Cheques, which is why I say get a No Fees Checking account with PC Financial).

HSBC

– No Monthly Fees

– 4.25% Interest (as of October 11th..currently 3.5%) paid monthly

– Free Unlimited Debits (yes, you get a debit card to make purchases at stores)

– Free Unlimited Bill Payments/Pre authorized payments

– Free Unlimited Withdraws (Part of the Exchange network. so free deposits/withdraws at HSBC/National Bank of Canada/Bank of Montreal)

– No Minimum Balance requirement

– Free unlimited Bank to Bank transfers

This completely blows away ING Direct or any of the Savings accounts with PC Financial because of the following

– ING Direct has 3.75% Interest (less 0.5% of HSBC)

– ING Direct debit cards cannot be used to make purchases, only withdraws from Banks machines

– ING Direct Cannot make bill payments

– Only 7 ING Direct locations in Canada

– Must wait 1 Day when Transfering Money out of PC Financial’s savings account (whether it be Interest Plus/Interest First accounts)

– Interest First rate is 3.05% (less 1.20% of HSBC)

– Need minimum $1000 in Interest Plus to match HSBC’s rate of 4.25% Interest

– limited to PC Financial/CIBC banks (not apart of the exchange network)

PC Financial No Fees Bank Account

– Free Cheques

– unlimited debits (same as HSBC)

– unlimited bill payments/pre authorized payments (same has HSBC)

– unlimited withdraws (same as HSBC, HSBC apart of the exchange network)

– Free unlimited Bank to Bank transfers (same has HSBC)

– Interest rate 0.10% on balance less than $1000 ..Interest varies to a maximum of 2.00% on balances over $25,000.

As you can evidently see, Choosing HSBC along with the PC Financial’s No Fees Bank Account (for Cheques) is the best way to do banking. I personal use HSBC 95% of the time and use PC Financial only when I need to write a cheque, then I’d visit a bank machine and withdraw money to deposit into No Fees Chequing to cover cheque amount (or you can do it online with the bank to bank transfers, but bank to bank transfers can take 2-5 business days, just the same as it would take to transfer money out of ING to your Bank account). Keep in mind you can also setup a pre-authorized automatic payments for the company you need to write cheques too, as HSBC can provide you with a VOID-CHEQUE form to fax to the company, which would eliminate the need for the No Fees Checking Account for cheques from PC Financial.

I hope this makes sense.

October 24th, 2007 at 6:35 pm

Yasmin says:

My hubby and I have been using PC Financial for a couple of years now, but are on the verge of changing back to a brick and mortar account. We used ING since it first came online, and held our mortgage with them a couple of years ago. But…at the end of the day, having a face to face relationship with bank tellers makes a difference in your dealings. Life is not black and white, and we find that the online and telephone banking service reps are not authorized to really do anything that is not by the rules (ie – waive a five day hold on a cheque or service fees).

October 31st, 2007 at 11:57 am

Mr.Frick says:

Hey Peter.

RBC has a 4% high interest savings account.

What do you think of that?

Thanks for all of your crap. It’s really useful.

October 31st, 2007 at 12:01 pm

Peter says:

Check out www.highinterestsavings.ca! There’s discussions there about the different savings accounts… I haven’t tried RBC myself

November 23rd, 2007 at 2:19 pm

Chet says:

I want to sign up for ING and get the $13 bonus Does anyone have a referal code I can use?

Edit: code sent

December 6th, 2007 at 9:22 pm

Emily says:

Email me for an ING referral code (emilya21 AT hotmail.com). For anyone else that is interested, to get the bonus you need to open an ING account with an initial deposit of 100 dollars to receive a bonus of 13 dollars if you use that code! The interest rate is 3.75%

Could anyone give me a referral code or sent me a referral (emilya21 AT hotmail.com) for icici bank. It’s 4.5% and 20 dollar referral bonus?

I also wanted to put in my 2 cents on high interest accounts. Personally I prefer the ones offered by “brick and mortar” banks because you can simply transfer the money from your savings into your chequing account with no delays or holds. This is especially convenient if you already bank with one institution and it’s nice to have everything in one place rather than scattered all over. The ones I am most familiar with are RBC’s high interest at 4% and Scotiabank’s Money master at 3.5%. Just be careful not to withdraw directly from them, you will be charged 5 bucks, just transfer into your chequing and then withdraw it from there. I also enjoying being able to go to branch and do my banking rather than just over the phone and online, real people and face to face financial advice are always a plus.

December 14th, 2007 at 11:09 am

Nadine says:

Hi there!

I need help!

I currently have a Canada Trust GIC (which makes pennies); It’s pointless. I also have a ING direct account, and a Canadian saving bonds account.

I am interested in getting a Achieva account seeing how they are offering 4.35% which is amazing. Does anyone know much about this company?

Thanks in advance.

December 15th, 2007 at 10:34 pm

Peter says:

Hi Nadine,

Achieva has been mentioned a few times in the comments to this post and is a legitimate bank. You should also ask your question on http://www.highinterestsavings.ca

April 3rd, 2008 at 10:12 pm

Dale says:

I would also like a referral code for ING direct, if any one has one that would be great! Is there a hands down high interest savings account that is better than the others, I am new to saving and just looking for the best possible account. Thanks. My email is [email protected]…if anyone has a code or advice?

June 2nd, 2008 at 9:40 pm

JoseMiguel says:

Hi,

My name is Jose Miguel, I am a new Canadian Resident in Missisauga, On.

I am looking for updated information about the best way to put my money in the Bank in order to:

. Gain the most interest saving account fee or other kind of account or services with high interest fees.

. Know what banking intitution is the most appropiate for

RRSP or Excange Traded Banking Service for me to

aply,

Thank you very much for your help.

i hope some body could respond me.

sinceraly

Jose Miguel

June 2nd, 2008 at 9:52 pm

Peter says:

Hi Jose, please post your question on the forums at http://www.highinterestsavings.ca. The community there should be able to provide you with advice.

September 5th, 2008 at 10:30 am

maurice says:

thanks for the info. i ve been in mutual funds for 30 yrs with 4 major banks and not made a dime..time to not listen to financial advisors who make a fortune with investors money and to buy gic..csb.é.high interest savings …..has anybody really made money with mutuals??

November 29th, 2008 at 6:52 am

GH says:

Does any one have comments about Canadian Tire Bank. Is it easy to use as far as linking ohter instutations to it. The pay 4.25 on two year GICS and offer a 4.3% for 90 days on new accounts.

November 29th, 2008 at 6:54 am

GH says:

maurice;

Stay away from mutual funds. They will keep you broke!

December 21st, 2008 at 7:51 am

SupaDupaFlyGirl says:

Hi, thanks for the post. I am a University student myself, trying to pay off these tuition fees. supposedly they’re deregulatingfees for all programs. scary. when i found this artical…i saw the light. thanks a lot. i am also intersted in your refersl code if you dont mind. thanks.

December 21st, 2008 at 7:51 am

SupaDupaFlyGirl says:

oh, srry incase of confusion, i was talking about ING direct. the referral code. thanks again.

January 5th, 2009 at 4:39 pm

Kyle Moriss says:

Hello

I want to transfer an amount from my credit card to my customer.

cose am on a business trip and am very busy now.Can you help me do that?

January 5th, 2009 at 5:22 pm

Peter says:

Sorry Kyle, I don’t have much expertise there. Try PayPal?

March 13th, 2009 at 5:25 am

Ron says:

I just signed up for an HSBC high interest savings account. HSBC is still holding the interest rate up at 3% while ING and RBC both offer 2% only at the moment. Any one an idea who else still offering high percentage(>2%) interest rates?

Reply from Peter: Try checking http://www.highinterestsavings.ca

April 2nd, 2009 at 8:18 am

Sandra says:

Thanks for all the information. I too agree that mutual funds are a scam. With the high interest rate in regular accounts, why pay some one to watch your money, and take the chance of loosing it at all. Mutual funds are for people who have more money than brains, and want a pretty printed portfolio to prove it. Take some initiative and some time to learn about money and how it works. Our society is ruled by money yet most people have no idea what their current account balances are, interest rates, ammortization dates, etc.

Over the years I have wised up and gotten out of "physical" banks and more and more into virtual banks. I currently have accounts at PCF and ING, however believe that PCF is a superior institution. Not only does it have the psychological comfort of being linked to CIBC a traditional bank, but it’s benefits of providing users with PC points to buy groceries, gift certificates and goods on-line is a great way to avoid tax.

Everyone needs groceries, makes more sense to get lots of points, buy them, and not have to worry about your T4. $50/year is not that much, why look for high interest if your money is going to be raped by the feds in the end? And in times like now that the prime rate is soooo low, maybe it’s wiser to pay off some debt before the rate skyrockets again.

I opened my PCF about 5 years ago, and discovered the PCF Mastercard account. The amount of points I’ve collected and used is astounding. I spend about $25K a yearon the MC and most of my banking on the PC savings and checquing accounts, and make about $1000 worth of points, that’s 4%, tax free, with full access 24-7, from anywhere in the world. Not only do you get points for using the mastercard and the banking, but you get points for certain balances, for opening accounts, for direct deposit of paychecks, etc. These points accumulate quickly and can be used on a variety of things.

The nice thing about the points is that when you purchase items online, they come to your door, you are not charged taxes on the points remeeded portion of purchase, and there are constantly promos for more opportunities to get more points.

I buy everything on my PCMC, even my utilities get direct billed to it. If I could pay my mortgage and get more points I would too. The key is to wait until 3 days before the payment is due, so you money in your high interest savings can get max fat, then dump it into the PCMC and pay it off in full.

Yes, paying it off in full every month is the key, that way it’s like being rewarded for using your credit card, and you don’t have to pay a fee, like other points program cards. This is the best way to max on points, interest accumilated, credit score boosting and shopping online (that saves you tax and gas and no postage on your part).

I only wish PCF had better rates on mortgages and lines of credit, but I guess they gotta make money somehow.

April 7th, 2009 at 7:01 pm

Pamela says:

Hello everyone, I have enjoyed reading all of your blogs. But I am still quite confused on where would be best for me to invest my money. Especially where the interest earned is free from being taxed. Can Someone help me to understand what my best option would be???? Pretty please!!! I’m a young parent and I want to do the best that I can for my little one’s future.

Reply from Peter: Check out the forums at http://www.highinterestsavings.ca/forum

April 19th, 2009 at 9:24 am

jasonc says:

For those of you thinking of opening the hsbc direct savings a/c. Think again, Hsbc Bank Canada currently has two call centers serving canadian clients. One in Vancouver and the other in Markham, ON. Come July 2009 both call centers will begin closing down and the jobs moved to india and china.

When you open an account Hsbc stores your personal information such as your SIN. Driver Lic #, date of birth, credit info . It also store information about your other bank a/c’s you may have(for the purpose of bank to bank transfers).

Both China and India have high levels of corruption. Staff in india are overworked and underpaid. They do not receive proper training. Trying to communicate with them especially when things go wrong can be a nightmare.

And what do you think about security of your personal info at these offices overseas

Your information will be viewed by people sitting half a world away. These are people who get paid about $5 a day for providing customer service over the phone. Its easy to be tempted when someone offers a few thousand $$$ to just copy customers personal information on to a usb drive.

http://www.technewsworld.com/story/51405.html?wlc=1240161060

Among other things that you might want to consider before opening an a/c. please verify with the financial institution if your information will be accessed outside canada.

For those of you who already have accounts with hsbc. You might want to speak with them about the timeline before the calls are routed to india.

Hsbc Bank Canada customer service # 1 888 310 4722

As of today the calls are still routed to their call centers in Vancouver and Markham. In a few months you will not be able to speak with some one in Canada.

Take Care,

JC

May 22nd, 2009 at 2:57 pm

hussain says:

ING DIRECT is not what is use to be….rates are so low

August 14th, 2009 at 8:10 am

Francois says:

I’m really disappointed with the handling of Citizens Bank of Canada closure. A few months ago I had lot of assets with TD bank than I move all these to Citizens Bank because they better match my values. I mean mostly because they are a credit union bank and they give more back to the community to improve both my and everybody quality of life and they’re more open to members feedback. Now Citizens Bank & Vancity are saying they move all my Citizens Bank assets to TD. That’s not going to happen. Over my dead body I’m now shopping for another credit union bank in Vancouver area. Any suggestions for another credit union bank that would match my values?

I’m now shopping for another credit union bank in Vancouver area. Any suggestions for another credit union bank that would match my values?

September 18th, 2009 at 10:01 am

Myau says:

what happened to highinterestsavins.ca??

the website doesn’t seem to be working anymore

did big bank shut it down?

Reply from Peter: Its web host has been having problems. Once things are back up I will be finding a new host.

October 3rd, 2009 at 2:48 pm

Russ says:

Sorry but I don’t support the idea of putting more

people out of work (online banking) to suit my own selfish needs. I make a habit of never using these new scanning aisles in grocery stores as well

October 4th, 2009 at 10:23 am

Ben says:

Has anyone done buisness with Ally? (www.ally.ca) They’re offering 2%, double what ING is offering. I found mixed reviews for Ally Bank which is an online bank in the U.S. The 2% seems a little too good to be true… any thoughts?

November 23rd, 2009 at 10:29 am

QueryCurio says:

I joined PC no fee account last week and transferred in exactly $2k but BUT only $1990 arrived in there and when I called up they fluffed around and said they don’t know where the $10 went and blamed an intermediary bank for the disappearance of the $10.

My gripe is THIS SHOULD NOT HAPPEN! there should not be some laissez faire oh oops $10 disappeared … if collectively $10 was disappearing from every PC account then that would be a suspicious white collar crime there

PC Financial’s marketing for this account is that there are no fees on everyday banking – and yet they can’t account for this mysterious $10 disappearance while the money was transferred electronically. And in any case they can’t charge $10 for ppl to deposit money in, thats ludicrous and even contradictory to the marketing for this account

January 30th, 2010 at 5:37 pm

kent says:

I with PC Financial for more then years and haft, have accounts with them. one high interest saving and other checking, as they request to cash the money only on checking account, the high interect saving can’t not cashing, have to transfer to checking account and sit there for 5 bossiness days then can cash the money, so I been deposit the moneys to my saving account for more then a year, last week I try to transfer some money on saving to checking, find out they closing my checking account and take away 20 dollar on it, i call them up, they tell me, because I not use the checking account for period that they close, I ask them how can I moving my money on saving account for cash out, they say just open new checking account again and deposit into it, I very upset, they took my 20dollar on checking account and close with out me noted, now tell me open new account again and put money in for them, and have saving lock in them can’t cash out. I have 18000 dollars in saving only make 18 dollars interest and have pay tax on top plus I can’t use my moneys, I call them up again, and tell them to close all my account and moving to somwhere ell, in more then ayears I deposit every months, no making money plus they keep steal my money, use the trick like about, even you have money in saving you can’t use, you haveto move to checking sit there before aweek then can cash out, that mean they keep your money other week, if you need money by the way, this no good for you, on my opinion, I hate they ‘s policy, and they not the pay high interect in saving. they suckup my 20 dollars, I let you people know to watch out the fine print they setup, it not good have saving acount with them. becouse you can’t cash the money anyway what for?

February 25th, 2010 at 8:53 pm

Blue Jays says:

Online banking is def. a smarter financial decision. Even if you’re making 3.5% annually, due to inflation 3%, your actually earning a pitiful 0.5%. Moreover, those gains will get taxed. Your not making much but it’s still better than traditional banks. Your getting charged monthly fees and services charges that should be waived and the usual payout is less than 1%. In return, these so called brick and mortar institutions use that money to lend out at an average rate of 14 times more than the meager interest you would’ve accumulated annually through financial offerings such as mortgages, line of credits, etc. In other words, Would you let someone steal your money? Where do you think they get billions of dollars from? Get with the program, if you know how to send an email. Online banking is just as easy.

February 27th, 2010 at 3:26 pm

Bud says:

Am repeating Ben’s request of October 4 2009. Has anyone has any investment experience with Ally?

Reply from Peter: Check out this forum, where several people have talked about Ally.

March 10th, 2010 at 10:27 pm

Curtis says:

I have been with Ally for about six months now – actually have about 16 accounts with them (I like to "envelope" my savings)…I have had nothing but good things to say – interest rate has remained steady, no wait time for customer service, and an easy to use interface for moving around your money…I wish they would get into RSP’s as well!

Nothing bad to say about them

May 11th, 2010 at 5:31 pm

Bill says:

Been with ING for over 8 years. The current rates are not quite as "rich" as they used to be. However, they mean "no fees", even on RSP withdrawals. Try and find that at any of the "Big Six" or their brokerages!

Great service. "Get’re done" attitude. Love them.

June 23rd, 2010 at 12:15 pm

msl25 says:

ALERT!!!

ALERT!!!

Dear Peter,

your other useful website,

www.highinterestsavings.ca is down!!!!

what is going on?

Reply from Peter: The hosting company said that there was a hardware failure. They’re replacing some hard drives, and it should be back up soon (I hope)!

June 24th, 2010 at 11:29 am

Enda Suparman says:

Dear Peter,

I’ve been shopping bank around for quite long now. I need a bank that can give me good interest yet no fee attach to it. I’ve been dealing with ING almost 3 years, I am happy with them.

I tried to not put all in 1 place, you know the saying "Don’t put all your eggs in 1 basket" so I’ve been looking other good bank and will makes my money grow.

Any suggestion for my money grow faster? I’ve been told about Bond and stock…but I really not sure about that. Lots of ppl say you will loose your money at the beginning, which I really dont like that idea.

Anyway…thanks for the help! hope to hear back from you soon!

June 24th, 2010 at 9:36 pm

MSL25 says:

thanks peter. and yes, the http://www.highinterestsavings.ca

is back now. for about 48 hours its down. glad for it to be back.

and to enda suparman, if you’ve been ING for quite a time, then i guess that’s it. because ING rates are the highest all, if not most, of the time. and if you want more action like investing in bonds, stocks, mutual funds, etf, hedge funds, derivatives, whatever, i suggest you read some books about it first.

remember, its a jungle out there with these kind of investments.

just go to your local library and check, "personal finance/investments" sections. i also want to go to the higher returns but higher risk scene but i am still low on finance. I guess you need at least $10,000 to start unless you wanna invest in "penny stocks" and remember, there are so much fees that goes with these investments more often is that it’s your finance advisor

or stockbroker that’s really getting income and not you.

anyway, good luck and please read some books first okay?

June 30th, 2010 at 12:48 pm

Georgiana Arnold says:

Can US Citizens create on-line accounts with Canadian Banks? I apologize for the typos in the two earlier e-mails.

Reply from Peter: I’m not sure. I’d suggest asking at http://www.highinterestsavings.ca/forum

July 2nd, 2010 at 6:21 am

joan eleanya says:

I have just immigrated to canada from uk(london)

open a scotia bank – the checking acct is full of charges & fees here and there…….my goodness

please some one recommend a currentacct/checking acct with no fees please

Reply from Peter: The people on the forum at http://www.highinterestsavings.ca should be able to help.

July 6th, 2010 at 11:27 pm

msl25 says:

ahh joan eleanya,

(sigh) YOU just made the same mistake i made

last year when i opened my very first canadian bank account!

[im a new immigrant too]

oh yes! i also opened at scotiabank (powechequeing account) and for the last

10 months it’s always deducting $3.95 per month from my account.

how can i get rid of it, i have to make my balance $1,500 so that

the monthly fee is waived but as you can see, it’s been 10 months,

and i am only living via minimum wage so i am still not making a progress

on the $1,500 minimum balance. why not drop my account then?

nahh, not yet. i have a love-hate thing with my scotiabank and besides

i have already set up some automatic deductions/contributions to that account, even the CRA is connected to that account of mine, so its not easy to just drop that account.

my question is.. what province are you living right now?

because if your on British Columbia, then check out Coast Capital Savings. I recommend it. they offer free checking. honest. i have an account with them.

November 26th, 2010 at 11:08 am

Chantel says:

Do not deal with this bank. They may not have fees, but you will encounter many other potential problems as a result, they are a virtual bank so you can only deal online or with a machine, they have lnger holding periods on your account because they are virtual. I put 600 in my account from a savings account after clearing a large cheq that i could access in 2-3 days. I was given 500 in advance so i had somemoney in hand, I put it into my Presidents Choice account thinking it would be better to use to pay bills and get my sons medicine. Little did I know that I was only allowed to use 100, the rest was being held for 5 bus days! There was nothign they woudl do for me, and to cancel my account they said I can write myself a cheq to get the exact funds out OR they can transfer it wirelessly, I said transfer it, they said well you ahve to wait 5 days, then it will take 7 days to close the account THEN you can have your money back.. None of this helped me. I had problems with them in the past years ago but thought I woudl try again since I hadnt been working after a car accident and didnt want to pay fees for an account. Now Im just trying to get it closed… Oh and in 6 mths time they will review whether or not they will take the holds off .. this is a new account, with no negative activity. Thanks alot for your help Presidents Choice… I will stick with Scotibank instead..

July 26th, 2012 at 4:58 pm

nita says:

hi peter,

love your site, i’ll be quick… in regards to the high interest accounts, i am trying to figure out the whole compounding interest monthly if that bumps them up. i can’t figure this stuff out but wondering if you can do a list with that included in rating. anyways, thanks for all your help with this stuff. take care!

-nita

Reply from Peter: It makes a small difference, but most savings accounts have interest accrued daily and compounded monthly, so for comparison sake I don’t think you have to consider that.

February 21st, 2013 at 8:28 pm

Robyn says:

Ally bank is now closing as of April 30th. RBC ate it and is not letting it live. They only wanted the auto finance side. Is this a message for Canadians? We only want pre-existing loans but not a vehicle to encourage savings?