Skype To Go review: Make Skype calls from a landline

One of the additional advantages of having a Skype subscription to call landlines is that you can use that subscription when you are away from your computer and not on Skype at all, from mobile phones and landlines. Called “Skype To Go“, it is a free add-on to an existing Skype subscription and functions just like a calling card.

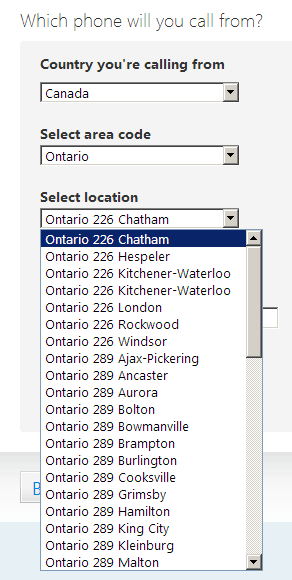

In short, you call a local number from your home or cell phone, thus incurring normal local charges, if any, to that number. Then you are prompted to dial the number you want to call out, thus incurring normal Skype charges. Depending on your Skype subscription, this might be free. If you register your number, the call is placed immediately; if you are calling from an unrecognized number, you have to enter one of your registered phone numbers and a PIN.

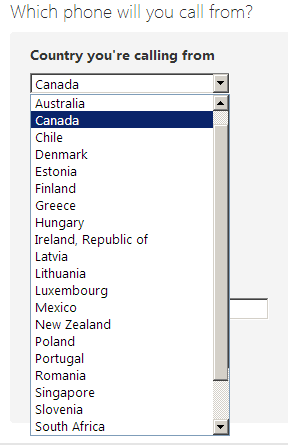

There are many Skype To Go call-in numbers around the world:

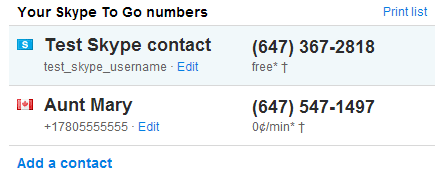

You can also register phone numbers or even Skype username contacts, and Skype will map a call-in number to that contact. If you call the call-in number, you will ring the mapped contact:

You can also use Skype To Go if you don’t have an existing Skype subscription — it will enable you to make calls at the normal Skype rates.

keung.biz. Hire my web consulting services at

keung.biz. Hire my web consulting services at  Follow us on Twitter

Follow us on Twitter